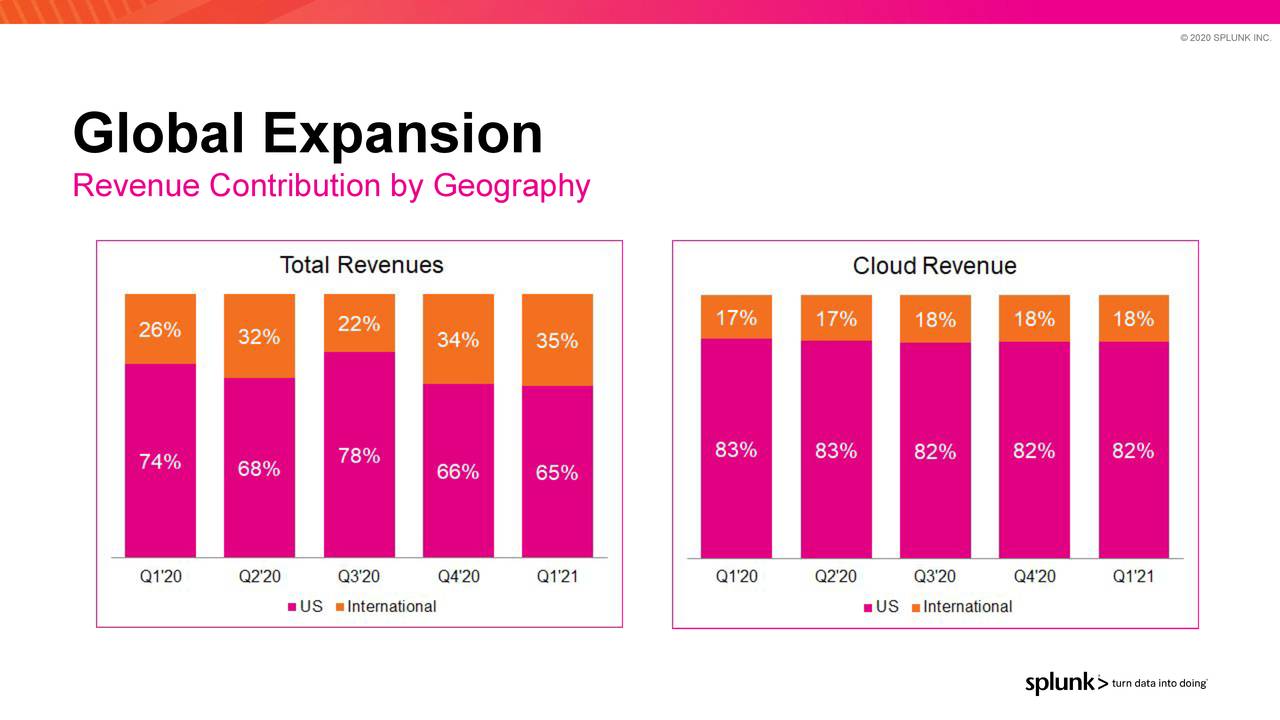

The next year will be rough as they need to do bigger deals to move the needle, but they have much bigger tech problems - and negative operating cash flow. They will try to pass that cost onto the user, but they are already known as being super expensive. The move to the cloud means they can “hide” their hardware bloat (out of sight, out of mind), but charging on virtual CPUs means that their margins will be in serious flux. The buy side (big hedge funds) essentially said, “f-you”, call me when oper cash flow goes positive and when you all have some clarity on this new licensing model. The sell side guys on the call were trying to understand, and it was a pretty pathetic display of their so-called financial acumen. Everyone offered congrats on the quarterly performance, but all the questions focused on trying to understand their revenue recognition and upcoming transition to the new licensing model to be revealed at. Listen to the call recording and read the transcript. So, the acquisition of SignalFx will play a meaningful part in the firm’s diversification of revenue streams into cloud-based customer services. In its recent earnings call, SPLK highlighted that ‘25% of business was cloud this quarter, and we expect it will grow to 50% over the next few years.’ Splunk CEO Doug Merritt described the deal as an acceleration acquisition designed to speed Splunk’s buildout of its cloud infrastructure business. The combination of Splunk and SignalFx will give application developers and IT departments a unified data platform that allows them to monitor and absorb data in real-time, no matter the infrastructure or scale, in order to cut costs, boost revenue and improve the customer experience. SPLK is acquiring SignalFx for its monitoring and metrics tools for cloud-based infrastructures.Īs Splunk stated in the deal announcement, market’s increase of 0.2%, as the chart below indicates:Įarnings surprises versus consensus estimates have been positive in twelve of the last twelve quarters, as shown in the chart below:Īnalyst sentiment in recent earnings calls has been relatively stable, as the linguistic analysis shows below:

#Splk seeking alpha software#

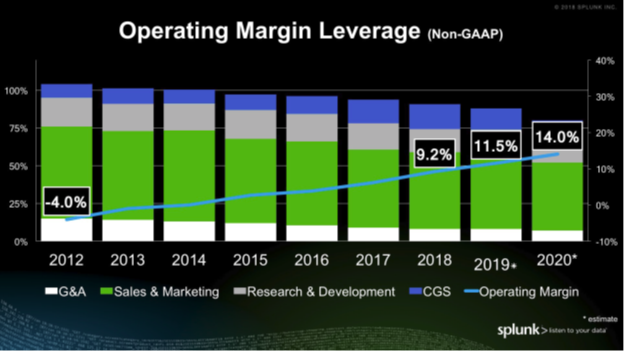

Software industry’s rise of 19.1% and the broader overall U.S. In the past 12 months, SPLK’s stock price has risen 19.2% vs. Management reaffirmed its full-year non-GAAP operating margin expectations post-closing of the transaction.Ī review of the firm’s most recent published financial figures indicate that as of April 30, 2019, Splunk had $1.67 billion in cash and investments and $3 billion in total liabilities of which $1.65 billion were convertible senior notes.įree cash flow for the three months ended April 30, 2019, was $20.1 million.

Splunk disclosed the acquisition price and terms as ‘$1.05 billion…, approximately 60% in cash and 40% in Splunk common stock.’ Source: Sentieo Acquisition Terms & Financials Major vendors that provide monitoring services include: The Asia Pacific region is expected to grow the fastest by region, while North America will remain the largest region by total demand.

#Splk seeking alpha drivers#

The main drivers for this expected growth include an increase the use of data by organizations and growing Internet of Things deployment. This represents a forecasted CAGR (Compound Annual Growth Rate) of a very strong 28.32% between 20. Market & CompetitionĪccording to a 2018 market research report by Zion Market Research, the infrastructure monitoring market is expected to reach nearly $15.2 billion by 2024. Investors have invested at least $178 million and include Tiger Global Management, General Catalyst, CRV, and Andreessen Horowitz.

Management is headed by co-founder and CEO Kathik Rau, who was previously VP Products at Delphix and VP Product Management at VMware.īelow is an overview video of SignalFx’ approach to microservices monitoring: San Mateo, California-based SignalFX was founded in 2013 to provide IT infrastructure monitoring services to enterprises. With the acquisition, Splunk is doubling down on cloud-based solutions as it seeks to diversify its revenue streams and take advantage of the historic shift of the enterprise to the cloud. SignalFx has developed real-time IT infrastructure monitoring and metrics tracking for cloud, microservices, and applications. Splunk ( NASDAQ: SPLK) announced a deal to acquire SignalFx for just over $1 billion in cash and stock.

0 kommentar(er)

0 kommentar(er)